EFE client portal

Project Overview

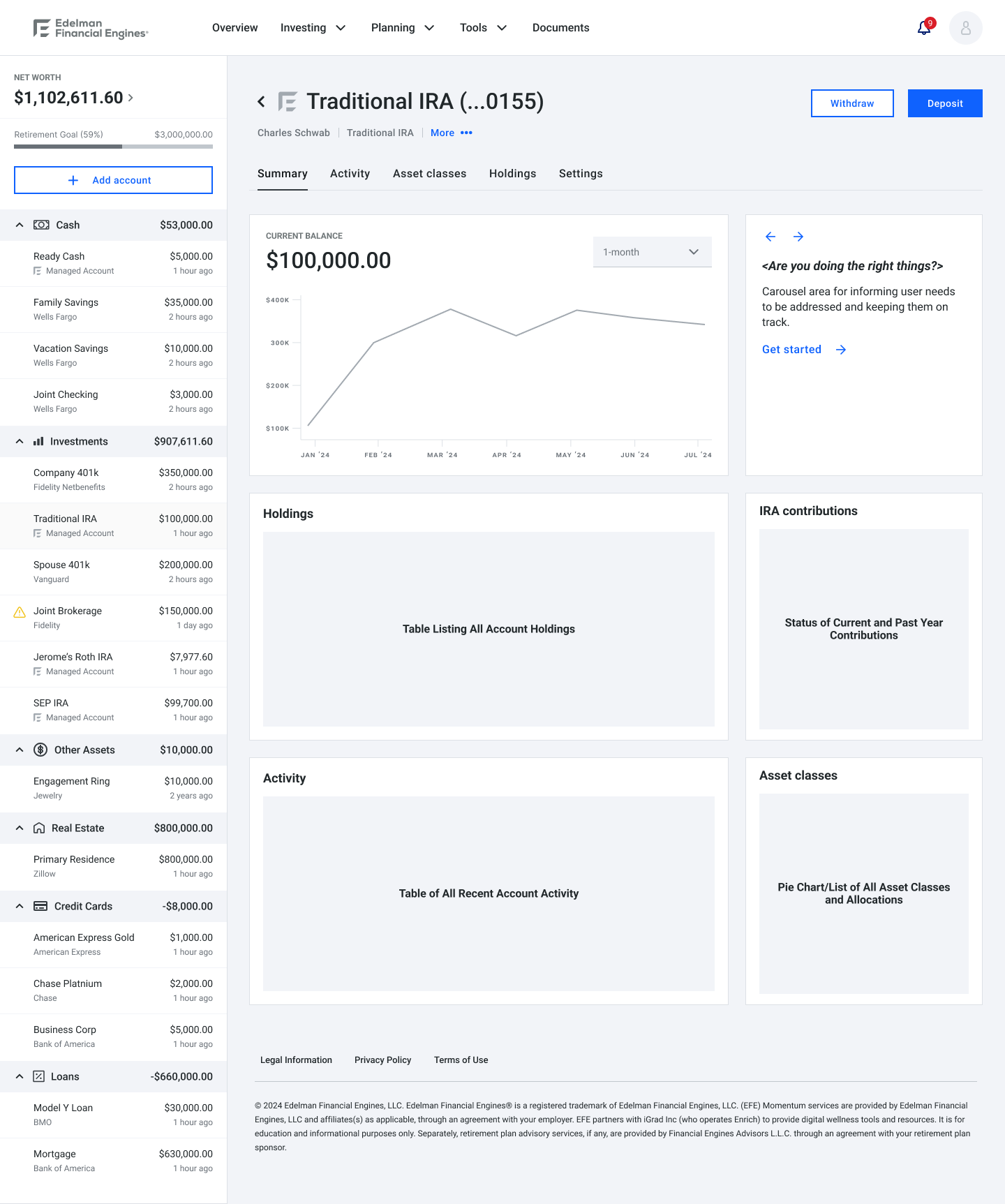

The Edelman Financial Engines Client Portal redesign aimed to modernize the self-service experience for individuals actively building their net worth—especially the 'everyday millionaire.' After the success of the Momentum Financial Wellness Checkup, it became clear that this tech-savvy audience expected more control over their financial tools. The legacy portal lacked basic account management features, creating friction and dependence on financial planners. The new design introduced a seamless, autonomous experience aligned with evolving client expectations and evolving business priorities driven by new leadership direction. .

As the Lead Product Designer, I drove the end-to-end UX strategy—including user research, design ideation, wireframing, and implementation of key self-service capabilities—while navigating the complexities of designing within both the legacy Edelman brand and the newly evolving brand identity. This new approach required careful consideration of visual consistency, tone, and usability across different systems.

SOlution

We reimagined the portal around self-service and transparency. Users could now:

Add, view, and manage accounts without planner mediation

Access real-time financial data and planning tools

Personalize their dashboards for smarter decision-making

View and interact with their plan

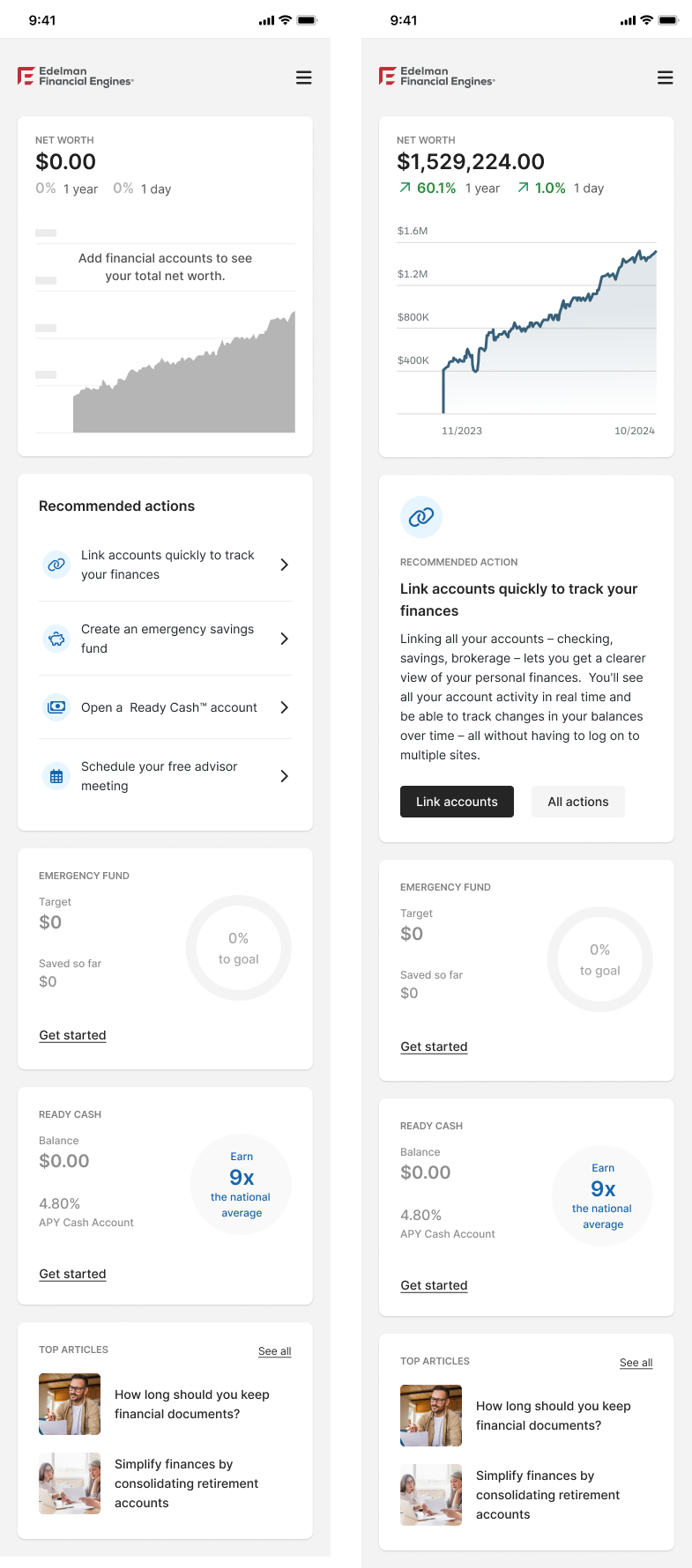

The interface was minimalist, data-forward, and optimized for mobile use, ensuring high engagement and accessibility. As part of Edelman's rebrand, the team and I also delivered a new design system—updating components and creating new design tokens in both the legacy and new brand styles—to maintain continuity while transitioning users to the modernized look and feel.

My Role: User Research, Journey Mapping, IA, Interaction Design, UI Design, Prototyping

Tools: Figma, Miro, Google Analytics

Discovery & research

user research

As Lead UX Designer, I partnered with the Consumer Insights team to conduct surveys, in-depth interviews, and behavioral analysis to uncover key needs of our primary users—tech-savvy, mid- to high-net-worth individuals seeking greater financial independence. Research revealed that:

Users wanted autonomy in managing their financial lives

Transparency and real-time access were essential to building trust

Seamless integration with Edelman Financial services enhanced overall experience continuity

Competitive Analysis

I conducted a comprehensive competitive audit of top-performing financial platforms to identify emerging trends and user experience best practices. Across the board, platforms were shifting toward:

Automation of routine financial tasks

Mobile-first, highly intuitive interfaces

Personalized dashboards enhanced by AI-driven insights

These insights were especially critical in guiding the new design system, ensuring our product was both current and flexible enough to evolve with the new Edelman brand.

KEY INSIGHTS

Heavy reliance on planners created unnecessary friction

Clients demanded speed, autonomy, and mobile-first access

Personalization and real-time transparency significantly increased user trust and satisfaction

concepts

We started with low-fidelity sketches to test the layout of core self-service flows. These were followed by:

Mid-fidelity prototypes to validate navigation and account management features

High-fidelity clickable prototypes used in usability testing and stakeholder demos

Accessibility Considerations

WCAG-compliant color contrast

User interface components and navigation must be operable

Simplified language for readability

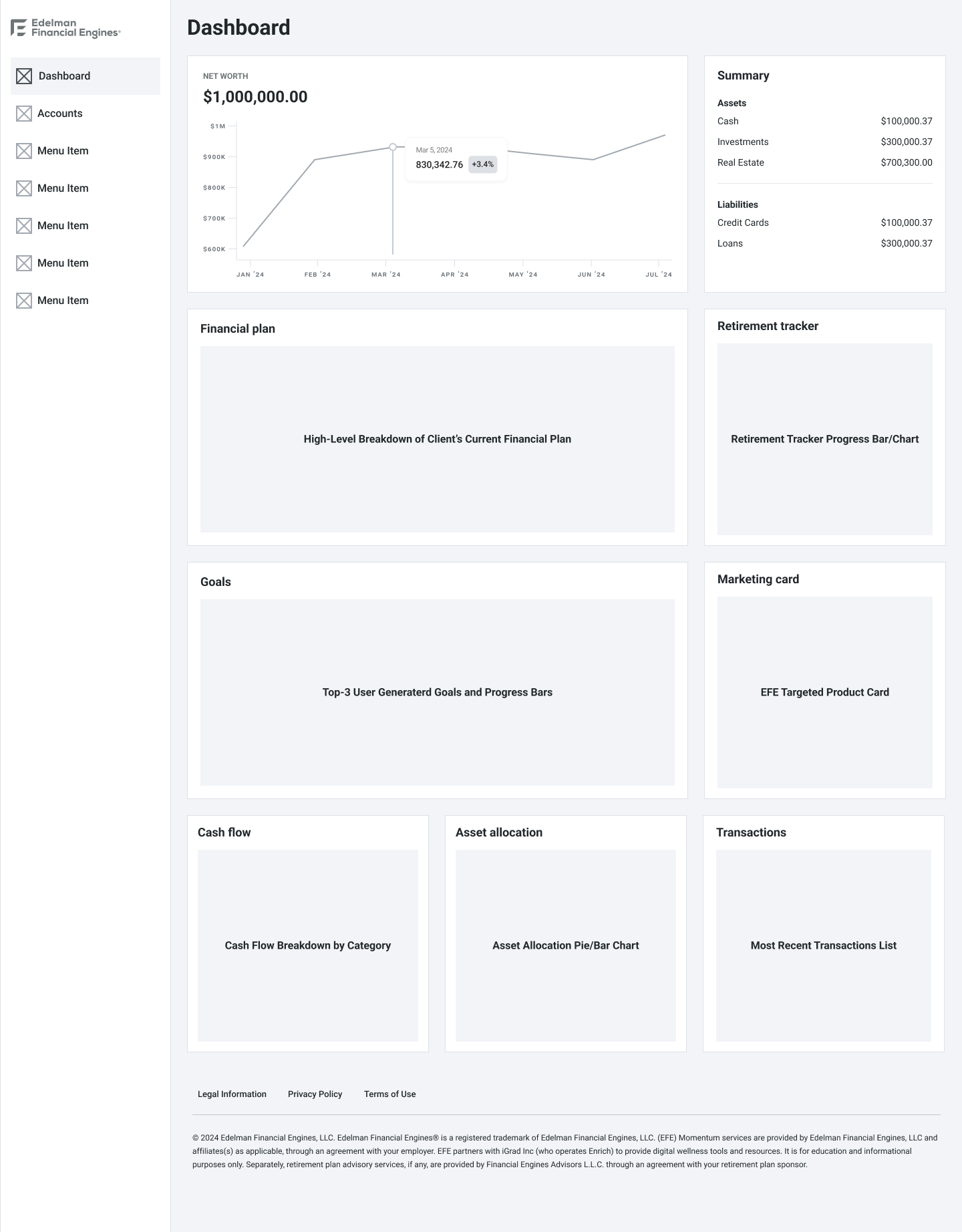

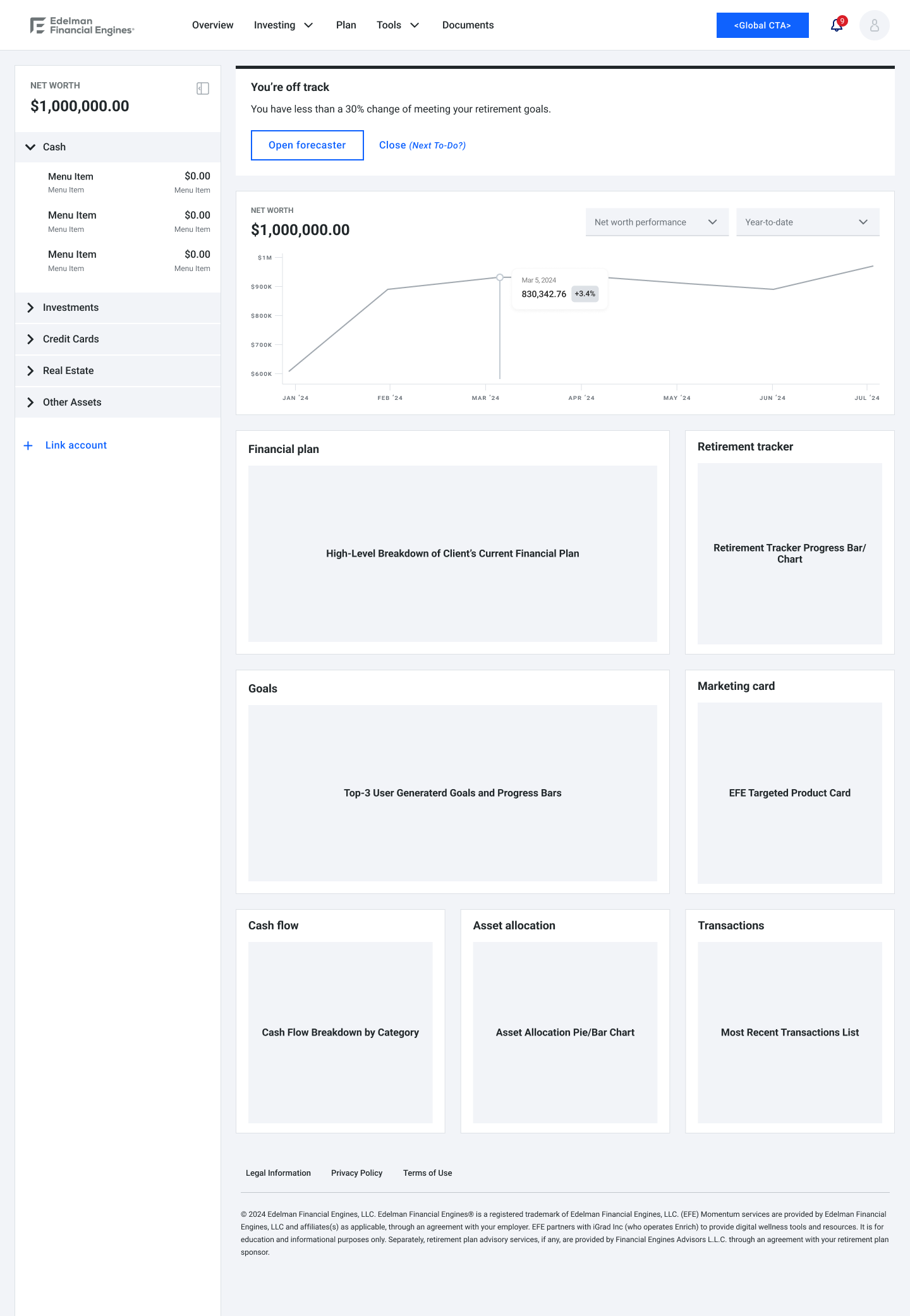

Mid-Fidelity wireframe Exploration

Below is a sample size showcasing distinct exploratory user flows for navigation and page layouts/hierarchy, and corresponding mid-fidelity wireframes to support this project’s early design phase.

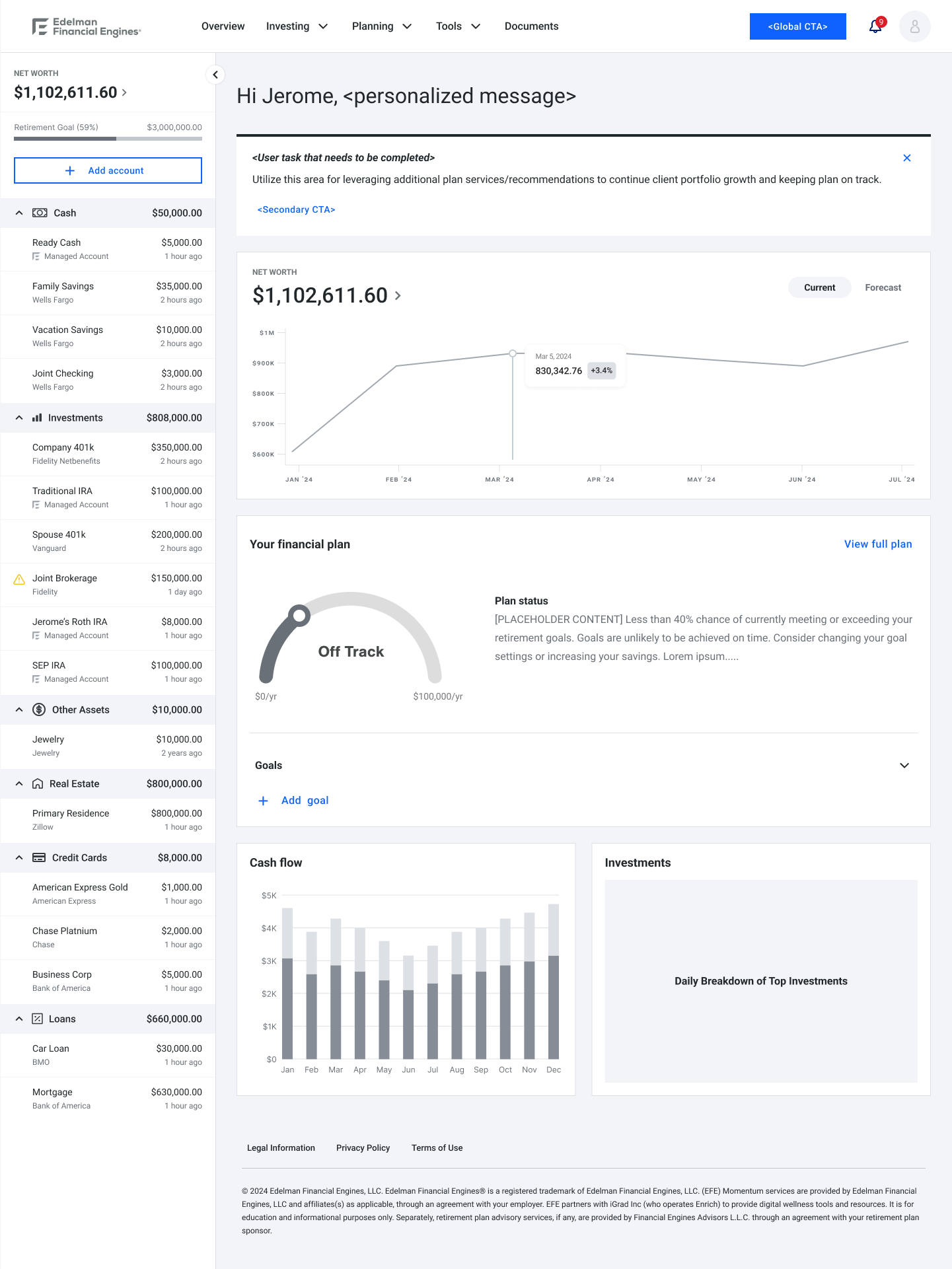

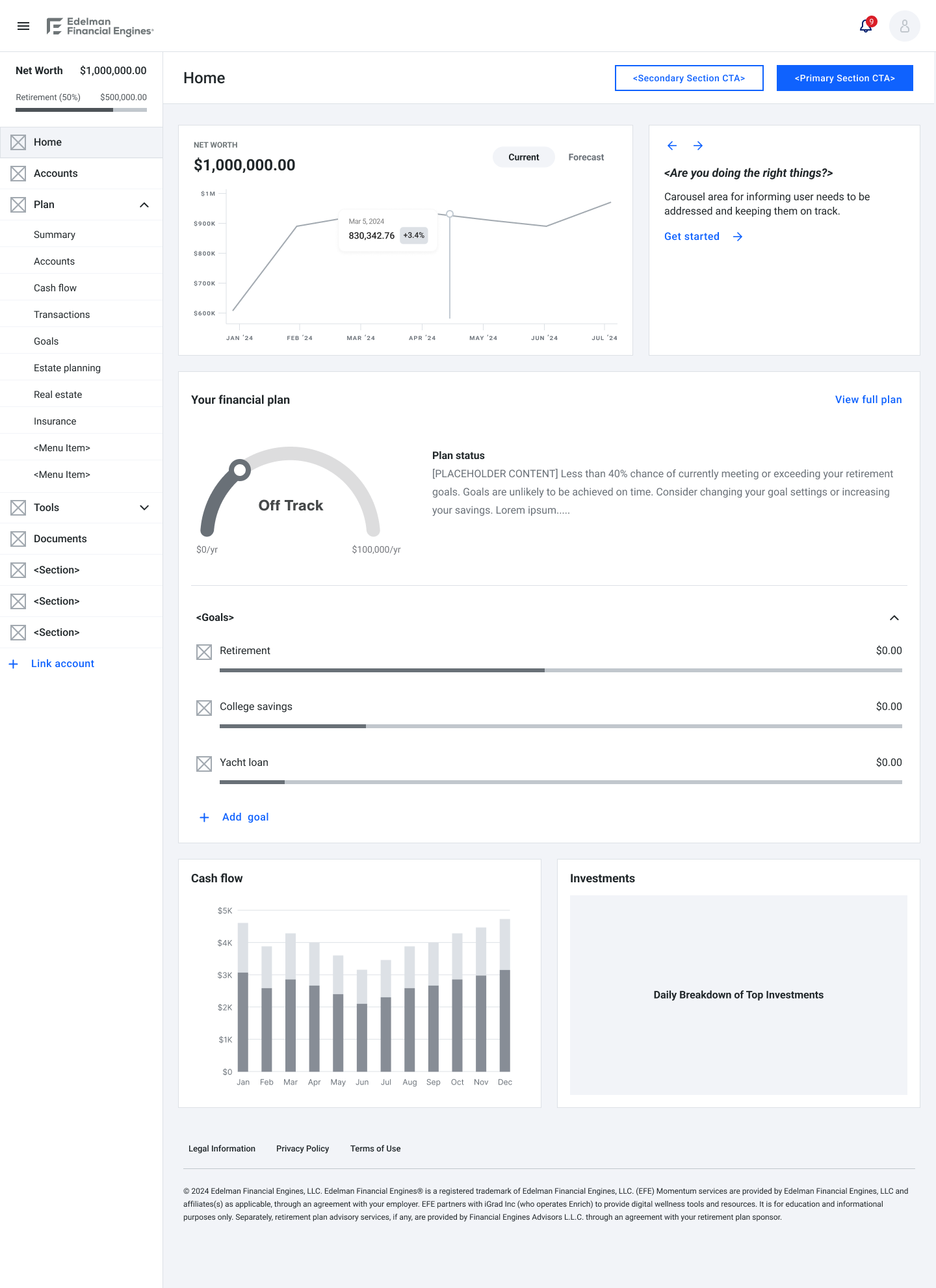

High-Fidelity UI Concepts

The UI mockups below incorporate our new design system explorations prior to the final direction being decided.

UI mockups

Design Strategy

Minimalism & Clarity: A clean interface that allowed data to shine

Personalization: Dashboards tailored to user goals and behaviors

Mobile Optimization: Fully responsive design for access on the go

Accessibility: High-contrast visuals, simplified content for financial literacy inclusivity, and WCAG-compliant elements

Accessibility Considerations

WCAG-compliant color contrast

High-contrast visuals

Simplified language for readability

impact & reflections

Challenges Faced

Driving adoption among advisor-dependent users

Merging modern UX with legacy systems

Meeting compliance while enabling automation

Ensuring brand consistency across legacy and rebranded designs

Lessons Learned

Digital-first, research-driven design is a competitive edge

Reducing friction boosts engagement and retention

Consistent, modern branding builds user trust

Next Steps

Facilitating the migration of existing clients to our redesigned product

Enhance mobile functionality

Strengthen compliance to support scalable automation